In the dynamic world of finance, algorithmic trading strategies are emerging in popularity as investors seek to maximize their profits. By leveraging sophisticated algorithms and real-time market data, these systems can execute trades with precision, often surpassing the capabilities of traditional traders. To harness the full potential of automated trading, it is essential to hone the intricacies of these strategies and implement them effectively.

- Construct a Robust Trading Plan: A well-defined trading plan serves as the framework for any successful automated strategy. It should outline your threshold for risk, investment goals, and the specific market conditions that will trigger trades.

- Validate Your Strategy: Before deploying your strategy in live markets, it is crucial to meticulously backtest it using historical data. This process allows you to evaluate its performance under various market scenarios and identify any potential weaknesses or areas for improvement.

- Monitor Performance and Make Adjustments: Continuous monitoring of your automated strategy's performance is paramount. Analyze the data and make adjustments as needed to enhance its effectiveness over time.

Bear in mind that automated trading, while potential, is not a foolproof path to riches. It requires dedication, constant learning, and a willingness to adapt to the ever-changing environment of financial markets.

Decoding Technical Indicators: A Deep Dive into the ADX Trend Strength Strategy

The Average Directional Index (ADX) is a popular technical indicator utilized by traders to determine the strength of a trend. Formulated by Welles Wilder, the ADX provides insights into whether a market is experiencing a strong or weak trend. Exploiting the ADX in conjunction with other indicators can strengthen your trading strategies by pinpointing potential buy and sell signals.

- Traders can use the ADX to filter trades based on trend strength.

- High ADX values point to strong trends, while low values imply weak trends.

- Combining the ADX with price action and other indicators can provide a more complete trading picture.

This article will delve into the intricacies of the ADX, investigating its formula and providing actionable strategies to capitalize its power.

Unlocking Market Trends with Advanced Technical Analysis

In today's dynamic financial landscape, investors are constantly exploring new methods to gain an edge. Advanced technical analysis provides a powerful framework for deciphering market trends and identifying lucrative opportunities. By employing sophisticated charting patterns, oscillators, and indicators, traders can reveal hidden signals embedded within price action. These tools enable investors to anticipate potential market movements with greater accuracy, ultimately boosting their trading strategies.

Through meticulous analysis of historical data and real-time market conditions, traders can develop a deep understanding of market psychology and identify recurring patterns. This knowledge empowers them to make informed decisions based on objective evidence rather than subjective instincts.

By Trading Strategies mastering the intricacies of advanced technical analysis, investors can navigate the complexities of the financial markets with confidence and increase their chances of achieving long-term success.

Trading Signals and Risk Management: Implementing the ADX Strategy

Successfully integrating trading signals into your methodology requires a robust risk management framework. The Average Directional Index (ADX), a popular momentum indicator, can provide valuable insights for traders seeking to pinpoint potential trend reversals. By combining ADX signals with sound risk management practices, you can improve your trading results.

- Initially, understand that the ADX itself does not suggest buy or sell trades. It chiefly measures the strength of a trend. A high ADX value suggests a strong trend, while a low value indicates a weak or wavering market.

- Next, consider using other technical indicators in conjunction with the ADX to confirm potential trading opportunities. For instance, you could incorporate moving averages or candlestick patterns to identify entry and exit points.

- Above all, always implement a specified risk management strategy. This must include setting stop-loss orders to limit potential drawdowns and determining your position sizing based on your appetite.

Harnessing the Power of Automation: Building Your Own Algorithmic Trading System

The realm of finance is continuously evolving, with technology driving unprecedented shifts in how markets operate. Amidst this dynamic landscape, algorithmic trading has emerged as a powerful tool, enabling investors to execute trades at lightning speed and capitalize on fleeting opportunities. Crafting your own algorithmic trading system presents a compelling opportunity to leverage the immense potential of automation. By meticulously designing and implementing algorithms, you can program your trading strategies, freeing up valuable time and potentially boosting your returns.

- Building a robust algorithmic trading system requires a multifaceted approach. It involves a deep understanding of financial markets, programming languages such as Python or R, and statistical modeling techniques.

- Evaluating your algorithms against historical data is crucial to assess their performance. This process allows you to identify strengths and weaknesses, refine your strategies, and reduce the risk of substantial losses.

- Implementation of your trading system can be achieved through various platforms, including broker APIs or dedicated algorithmic trading software. Continuous monitoring and optimization are essential to ensure that your system remains relevant and profitable in a constantly shifting market environment.

Embarking on the journey of algorithmic trading can be both challenging and rewarding. With perseverance, you can leverage the power of automation to potentially unlock new avenues for financial success.

ADX Strategy: Identifying Strong Trends for Optimal Trading Decisions

The Average Directional Index (ADX) is a popular technical indicator utilized by traders to pinpoint strong trends in financial markets. By measuring the strength of directional movement, the ADX offers valuable insights into whether a market is trending upwards or downwards. Traders leverage the ADX in conjunction with other technical indicators to confirm trend direction and trigger trading signals. A high ADX reading typically suggests a strong trend, while a low reading signals weak or fluctuating market conditions.

- Understanding how to interpret ADX values is crucial for traders seeking to maximize their trading strategies.

- Additionally, the ADX can be used in combination with other technical indicators, such as moving averages and momentum oscillators, to confirm trading signals.

- By combining the insights from the ADX with other analytical tools, traders can make more informed and successful trading decisions.

Rick Moranis Then & Now!

Rick Moranis Then & Now! Shaun Weiss Then & Now!

Shaun Weiss Then & Now! Danny Pintauro Then & Now!

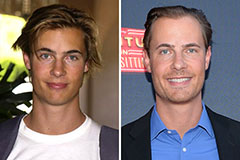

Danny Pintauro Then & Now! Erik von Detten Then & Now!

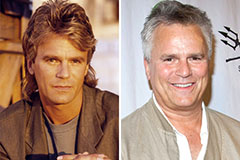

Erik von Detten Then & Now! Richard Dean Anderson Then & Now!

Richard Dean Anderson Then & Now!